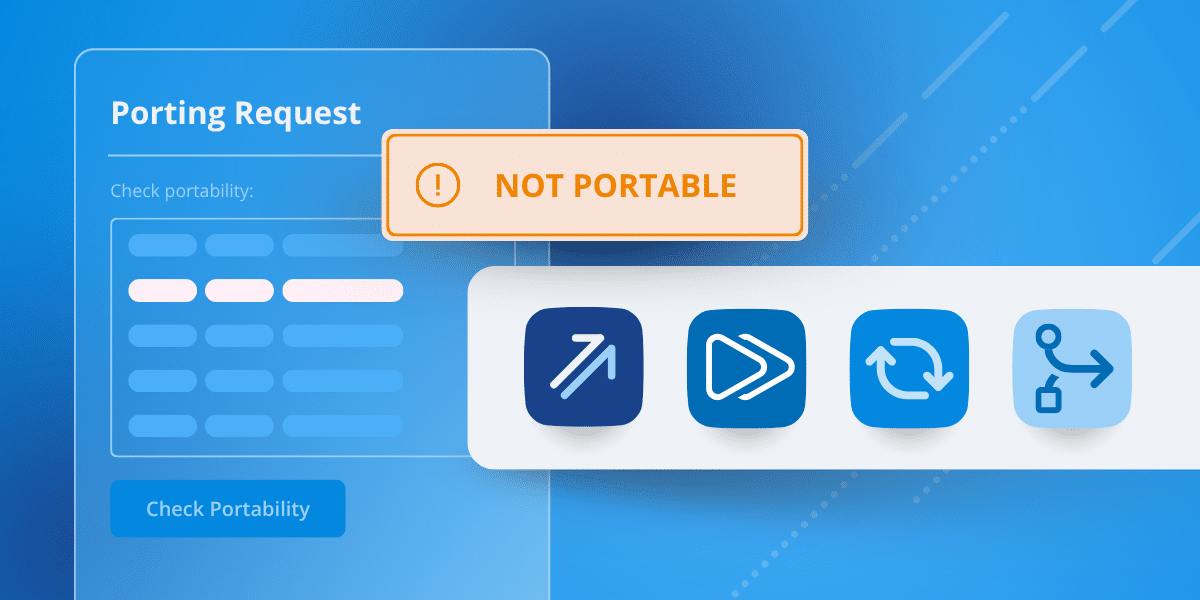

What happens when your voice consolidation strategy hits a regulatory wall?

You've made the business case. Leadership has signed off. Your plan to consolidate voice carriers and modernize your global infrastructure is finally moving forward.

Then you discover that 40% of your numbers can't be ported.

This is not a failure. It's a common challenge in vendor consolidation programs—and one that has proven solutions.

The key is understanding your options and choosing the right strategy based on your business priorities. Because here's the truth: porting limitations don't need to derail consolidation efforts. They just require a different approach.

In this guide, we'll walk through why porting restrictions exist, what alternatives are available, and how leading enterprises successfully modernize their voice infrastructure even when traditional porting isn't possible.

The Reality of Global Porting Limitations

Why Not All Numbers Can Move

Not all phone numbers can move between carriers. This often isn't about the technical capability of your cloud voice provider—it's about regulations, contracts, and infrastructure that vary dramatically around the world.

Regulatory Roadblocks

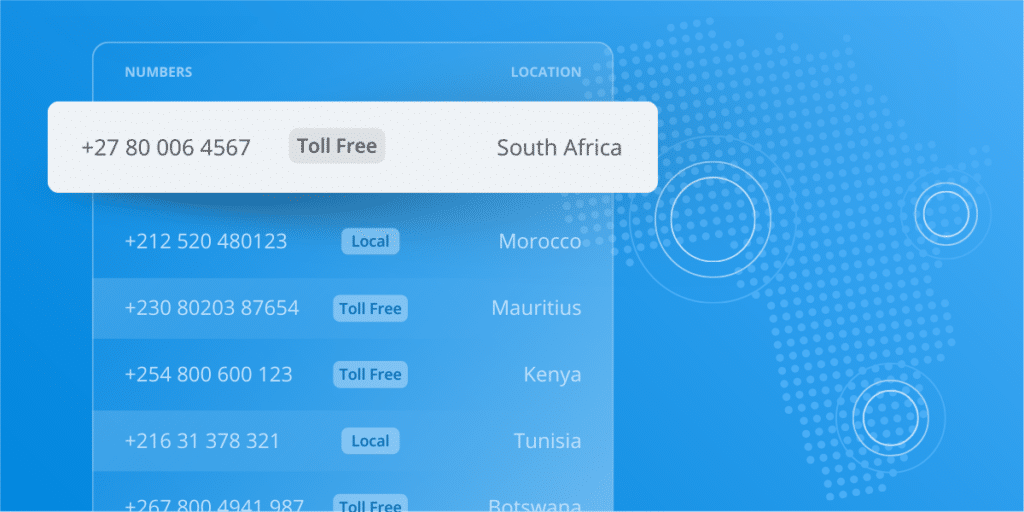

Different countries enforce vastly different rules about number ownership and transfers. Some require local business entities to own phone numbers, while others mandate that certain number types stay with specific carrier networks.

Brazil, for instance, requires specific business documentation for toll-free numbers that many companies simply don't have. China's complex telecommunications approval process can stop porting attempts before they begin. Several Middle Eastern countries maintain strict regulations around international calling and number ownership that make transfers nearly impossible. In India, limitations on bulk corporate number porting can derail enterprise-wide migrations.

Carrier and Contract Constraints

Your existing carrier may have built barriers to prevent you from leaving. Some legacy providers don't support modern porting protocols—not because they can't, but because they won't. Others have constructed their business models around making it difficult to switch, using contractual restrictions and technical roadblocks to retain customers.

The situation becomes even more complex with expiring contracts. If your carrier is discontinuing service in a region, your numbers might not have anywhere to port to. Companies that have been acquired often discover their numbers come with tangled contractual obligations that nobody fully understands until they try to move them.

Technical Impossibilities

Certain number types simply can't be moved due to how they're provisioned in the underlying infrastructure. Older toll-free formats that predate modern telecommunications standards are often technically impossible to port. Government-issued numbers for regulated industries like healthcare and finance typically must stay with their original carrier—it's not a business decision, it's hardwired into the system.

Some "vanity" numbers with custom routing present another challenge. The very features that make them valuable—special routing rules, unique configurations—also make them technically impossible to replicate on a new network. These numbers are less like phone numbers and more like permanent fixtures of their original carrier's infrastructure.

The Voice Modernization Imperative

Despite porting challenges, consolidation remains critical. Managing five or more voice carriers creates unsustainable overhead—your IT team wastes countless hours coordinating vendors, troubleshooting quality issues, and wrestling with incompatible systems for basic reporting.

The business impact is real: customers in Germany get crystal-clear calls while those in Singapore experience drops. You're paying for redundant services across carriers. When expanding to new markets, you start from scratch each time.

Your board demands vendor reduction. Customer experience requires consistent global quality. AI capabilities—conversational routing, real-time assistance—need a unified infrastructure to function. Meanwhile, competitors with streamlined voice operations move faster and spend less.

The cost of maintaining fragmented systems exceeds the complexity of consolidation. Even when porting isn't possible, that calculation drives modernization forward.

Strategic Options When Porting Isn't Available

The Parallel Path Approach

This strategy means running old and new numbers side by side while gradually shifting traffic to your modern infrastructure.

How it works

You acquire new cloud-based numbers in the regions where porting isn't possible. Your legacy numbers stay active with the old carrier. Over 6 to 18 months, you communicate the number change to customers and monitor the traffic shift.

Start by prominently displaying the new number on your website, email signatures, and marketing materials. Keep the old number visible but secondary.

Update your IVR on the legacy number to inform callers: "For faster service in the future, save our new number: [NEW NUMBER]."

Phase out the old number from printed materials as you go through natural reprint cycles. Track call volume on both numbers weekly. When the old number drops below 5% of total traffic, the transition is nearly complete.

Customer communication planning

Send emails to your customer database announcing the change. Be clear about when the old number will stop working, if ever. Some companies maintain the legacy number indefinitely as a courtesy.

Add the new number to your outbound caller ID wherever possible. Train your agents to mention the new number during calls.

Best for: High-volume established numbers with strong brand recognition.

The Forward-Only Strategy

This approach keeps your legacy numbers for inbound calls but routes all outbound traffic through your new modern infrastructure.

How it works

Legacy numbers continue accepting inbound calls through the old carrier. But when your contact center makes outbound calls—sales follow-ups, appointment reminders, customer service callbacks—those calls display your new numbers.

This strategy works particularly well with AVOXI's TrueLocal solution, which presents local caller ID in the customer's region, dramatically improving answer rates.

Configure your old numbers to forward to your new contact center infrastructure. The customer experience doesn't change—they call the number they've always called. But behind the scenes, the call routes through your consolidated platform.

Over time, customers save these new numbers. When they call back, they increasingly use the new numbers they see on their caller ID—naturally shifting traffic without forced migration.

Customer education

Since customers aren't being asked to change anything immediately, communication is straightforward. Simple messages like "You may notice a new number when we call you" are sufficient.

Best for: Contact centers prioritizing outbound sales and service.

The Strategic Number Refresh

Sometimes non-portable numbers create an opportunity to rethink your entire numbering strategy.

Market re-entry with a new number identity

This is the boldest approach: treat the number change as a deliberate business decision rather than a technical limitation.

Launch your new numbers as an improvement. "We're expanding our local presence" or "We're making it easier to reach us with new toll-free access" positions the change as a customer benefit.

Opportunity to optimize number types

When you're getting new numbers anyway, choose the best option for your business model—not just what you had before.

Consider whether local DIDs make more sense than toll-free for certain markets. Evaluate whether TrueLocal two-way calling would improve your outbound answer rates. You're not constrained by the legacy decisions of previous IT managers.

Integrated marketing campaign

Treat this like any other service enhancement. Develop a multi-channel campaign that introduces the new numbers as part of your commitment to better customer service.

Update all marketing collateral simultaneously. Launch email campaigns, social media announcements, and website updates in a coordinated push.

Best for: Companies undergoing rebrand, restructuring, or market repositioning.

The Hybrid Consolidation Model

For large enterprises with complex portfolios, the answer often isn't one strategy—it's the right mix across different regions and use cases.

Port what you can, strategically replace what you can't

Run portability testing on every number in your inventory. AVOXI can test porting feasibility across the world, giving you a clear picture of what's movable.

Port the high-volume, business-critical numbers where regulations allow. For everything else, choose the appropriate non-porting strategy based on traffic patterns and business importance.

Prioritize based on traffic volume and business criticality

Rank your inventory by monthly call volume. Numbers handling thousands of calls monthly need careful transition planning. Numbers receiving ten calls a month can simply be replaced with minimal customer communication.

Create a unified management layer

AVOXI's platform provides visibility into all your numbers—ported, replaced, or still in transition—in one dashboard. You get consistent analytics, call quality monitoring, and number testing regardless of how that number came into your inventory.

Best for: Large enterprises with complex, multi-region portfolios.

AVOXI's Managed Porting Service

Having the right strategy is step one. Executing it successfully requires a proven methodology and experienced partner. AVOXI uses a combination of software-based automation to process smaller porting efforts quickly, or for large, phased projects, employs its Managed Porting service. Let’s take a look at the Managed Porting Service in more detail:

Assessment & Planning Phase

Comprehensive inventory audit

AVOXI catalogs every number across all carriers, including numbers you might have forgotten about during previous acquisitions. Many companies discover they're paying for 20-30% more numbers than they thought they had.

Country-by-country portability testing

AVOXI's porting team submits portability requests for every number across our 100+ country coverage. This testing is free and comes with no obligation. You get a clear report showing exactly which numbers can port, which can't, and why.

Traffic analysis to prioritize business-critical numbers

We analyze your call detail records (CDRs) to understand traffic patterns. Which numbers handle the most volume? Which have the best answer rates? This data-driven approach ensures you spend your energy on numbers that matter.

Custom transition roadmap

Based on the audit, portability results, and traffic analysis, AVOXI develops a detailed roadmap customized to your situation—including timelines, resource requirements, recommended strategies, communication templates, and success metrics.

Risk assessment and mitigation planning

What happens if a port fails midstream? What's the fallback plan if customer complaints spike? AVOXI works with you to document answers to these questions upfront.

Implementation Options

Phased regional rollouts

Many enterprises choose to tackle one region at a time. Start with a lower-risk geography to test your processes, then expand to more critical regions.

Pilot programs for testing

A typical pilot lasts 2-4 weeks and includes 10-20 numbers across a few countries. This gives you real-world data on how customers respond and whether your communication strategy is effective.

Failover and redundancy planning

AVOXI builds redundancy into every transition. During the cutover period, both old and new systems remain operational with automatic failover configured.

Parallel running period with performance monitoring

After go-live, we track answer rates, call quality metrics (MOS scores, jitter, packet loss), and customer feedback. If any metric degrades compared to baseline, we troubleshoot immediately.

Customer Communication Support

Template communications for B2B and B2C audiences

AVOXI provides pre-built communication templates for every stage of the transition—email templates, website announcement copy, IVR script suggestions, and social media post ideas.

Multi-channel notification strategy

Customers don't all check the same channels. Email announcements, website banners, IVR messages, social media posts, and SMS notifications ensure customers hear about changes multiple times through different media.

Transition timeline management

Initial announcement → Reminder at 50% point → Final notice → Confirmation. AVOXI manages this timeline for you, ensuring customers receive the right message at the right time.

Success metrics and KPI monitoring

Track answer rates, customer complaints, call volume trends, and agent feedback. AVOXI provides dashboards that track these metrics in real-time so you can spot problems early.

Ongoing Optimization

Post-transition performance analysis

Three months after go-live, AVOXI conducts a comprehensive review of how the transition performed against your original success metrics.

Number utilization review

Regular utilization reviews—quarterly or biannually—ensure you're not wasting money on numbers you don't need.

Recommendations for continued consolidation

AVOXI provides ongoing strategic guidance to help you maintain momentum toward a fully optimized, globally consistent voice infrastructure.

Making the Business Case

Cost-Benefit Analysis

Short-term transition costs vs. long-term operational savings

Yes, transitions cost money upfront. But these are one-time costs. The operational savings compound every month.

Calculate your current monthly cost of managing multiple carriers: vendor management overhead, time spent troubleshooting, duplicate charges, and inefficient routing. For most enterprises, the payback period is 12-18 months.

ROI timeline and projections

Year 1: Transition costs plus reduced operational costs in months 7-12. Typically neutral or slightly negative.

Year 2: Full year of reduced operational costs with no transition expenses. This is where you see positive ROI.

Year 3+: Continued savings plus additional benefits like faster market entry and better AI integration.

Hidden costs of maintaining the status quo

How many hours per week does your IT team spend managing voice vendor relationships? How many customer complaints relate to call quality issues? How many times has a voice outage impacted business operations?

These hidden costs of the status quo often exceed the visible transition costs by a significant margin.

Risk Mitigation Strategies

How to minimize customer disruption

Clear, early, and frequent communication is your best defense. Tell customers what's changing well before it happens. Maintain redundancy during transitions so customers never experience downtime.

Maintaining business continuity

AVOXI's approach includes automatic failover systems that route calls back to legacy infrastructure instantly if any issue arises. Staged rollouts reduce risk by limiting the scope of any single change.

Preserving competitive advantage

Position your transition as a strategic improvement, not a forced compromise. External communication should emphasize service enhancements: expanded local presence, improved call quality, and easier ways to reach you.

Success Metrics Framework

Operational KPIs

Number of vendors reduced, time spent on vendor management, incident resolution time, and number of trouble tickets.

Financial KPIs

Total cost of ownership (TCO), cost per call/minute, volume discount achievement, and unused number elimination.

Quality KPIs

Call quality scores (MOS), connectivity rates, uptime/availability.

Customer experience KPIs

Answer rates, customer satisfaction (CSAT), complaint trends, and first call resolution.

Define your baseline for all these metrics before the transition begins. Then track them monthly during and after implementation.

Porting limitations shouldn’t derail consolidation—with the right strategy

Discovering that significant portions of your number inventory can't be ported is not a project failure. It's simply a reality of operating in a complex global regulatory environment.

The strategies outlined in this guide—Parallel Path, Forward-Only, Strategic Number Refresh, and Hybrid Consolidation—provide proven options moving forward.

The cost of inaction exceeds transition complexity

Every month you delay consolidation, you're paying the price of fragmented infrastructure. Your IT team spends hours managing multiple vendor relationships. Your call quality varies unpredictably across regions. You can't leverage modern AI capabilities that require a consolidated voice infrastructure.

These costs compound over time. Meanwhile, transition complexity is a one-time challenge with clear timelines and proven methodologies.

AVOXI's role as a strategic partner

AVOXI brings more than phone numbers to your consolidation project. We provide end-to-end support from initial assessment through post-transition optimization, 100+ country porting expertise, plus proven strategies for non-portable scenarios, and dedicated project management for complex transformations.

Start with a portability assessment

AVOXI offers a free, no-obligation portability assessment that includes:

- Complete inventory audit of your current voice infrastructure

- Country-by-country portability testing

- Custom transition roadmap with strategy recommendations

- ROI analysis showing projected costs and savings over 3 years

Ready to explore your options?

Your voice modernization strategy doesn't have to be held hostage by porting limitations. With the right approach and experienced guidance, you can achieve your consolidation goals while maintaining seamless customer service.

The question isn't whether it's possible. It's when you're ready to start.

Need Help Getting US Phone Numbers?

We're here to help! Contact us today so we can help find the right business phone number for you.